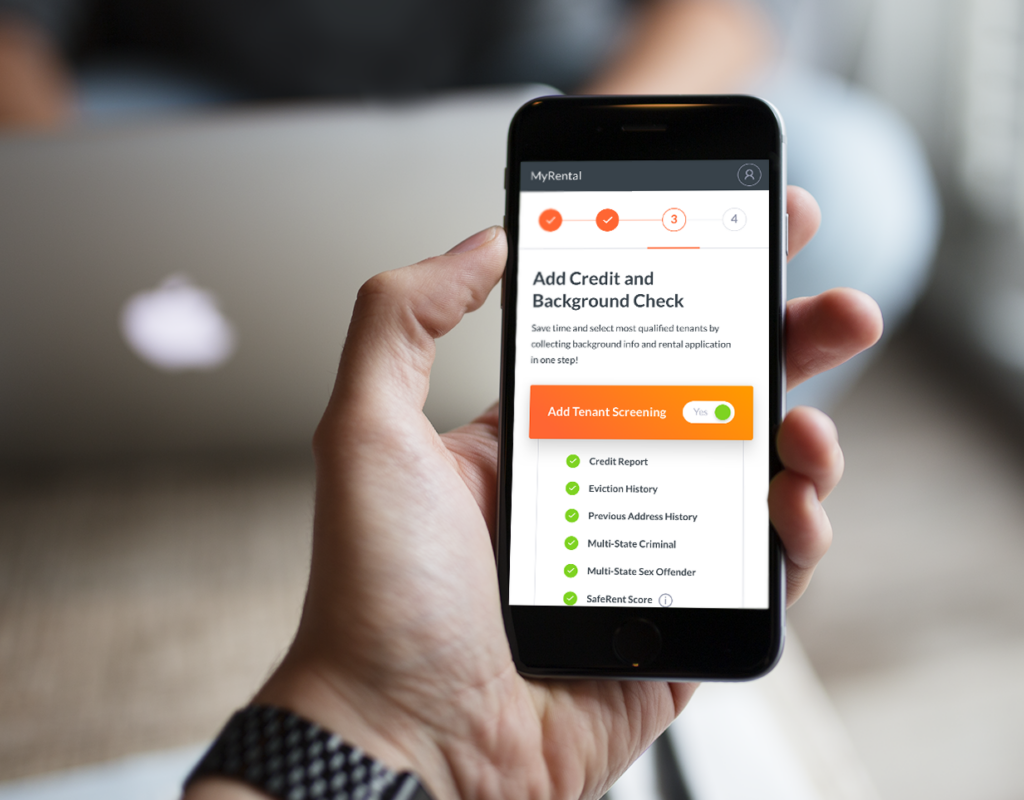

SafeRent Solutions connects you with comprehensive and up-to-date information, which helps to ensure a degree of consistency and reliability, and reduces reliance on judgment calls by leasing staff.

Minimize risks of non-payment, tenant eviction, property damage, and get the complete picture with SafeRent resident screening reports.

- Credit Reports – Easy-to-read and understand applicant information, including payment defaults and previous residences. Credit reports can include FICO Score – Experian, Transunion, or Equifax.

- Eviction and Address History – Gain access to housing court data, which include judgments for rent and/or possession, along with prior inquiries supplied by courthouses across the county. Address history includes additional addresses not linked to a credit report, such as a relative’s house or informal rental agreements.

- Multi-State Criminal Data – These reports display felony and misdemeanor data, available in most states plus Washington, D.C. Leasing professionals use this product to get more comprehensive data than what’s available in single-state reports.

- Delayed Criminal – Supplement to the Multi-State Criminal Plus data to cover additional jurisdictions. These searches cover a majority of the 50 states at the statewide and county level.

- Multi-State Sex Offender Search – Check registered sex offenders using sources nationwide, including the Department of Public Safety and other law enforcement agencies. Registry available for all states and Guam.

- SafeRent Score – Our proprietary SafeRent Score helps identify tenants more likely to pay rent on time and stay for longer periods of time. Because SafeRent Score is based on an analysis of key rental data, it is more reliable than a standard credit score for evaluating your applicants.

- Alternative Credit for SafeRent Score – Does your applicant have a thin credit file? Data from payday loan companies, rental purchase stores, credit unions, and other nontraditional consumer finance, when available, can help identify high and low-risk tenants.

- SafeRent ID Trust® – Verify an applicant’s identity with insights from multi-dimensional data sources and real-time risk assessments at the application phase.

MyRental™ offers self service tenant screening solutions to landlords, real estate agents, brokerages, MLS, and property managers, so they can identify qualified applicants.

For more information please call (800) 811-3495 option “Client Services” or email [email protected] to learn more.